Frequently Asked Questions

How does my contribution reach the schools?

How does my contribution reach the schools?

How does my contribution reach the schools?

You may designate your preferred school from our list of partner institutions, or you may request that your contribution be undesignated and used where needed most. The Pennsylvania Education Partnership LLC makes contributions to Jewish day schools through the Foundation for Jewish Day Schools (FJDS), a 501 (c)(3) organization.

PEP also makes contributions directly to DCED-approved Scholarship Organizations throughout the Commonwealth.

How do I claim my tax credit?

How does my contribution reach the schools?

How does my contribution reach the schools?

The accountants for the PEP LLC entities prepare the K-1s after the close of the calendar year. Each PEP Member will receive a PA K-1 and a Federal K-1 which are sent by the beginning of February of each year.

These forms are used to claim the PA Tax Credit and possibly a Federal Charitable Deduction.

Please consult your tax adviser regarding your unique tax circumstances.

Is there a maximum or minimum contribution?

How does my contribution reach the schools?

Can I participate both as an individual and a business?

•For a BUSINESS submitting its own application, the maximums are:

•EITC/OSTC/EIO: $833,333 contribution ($750,000 tax credit)

•PKSO: $221,111 ($200,000 tax credit)

•There is no minimum for a business entity applying on its own.

•For INDIVIDUALS submitting through PEP LLC, please note:

•There is minimum participation of $6,000

•Pennsylvania has no maximum for individual participation through one or more SPEs.

Can I participate both as an individual and a business?

Can I participate both as an individual and a business?

•Yes! A business owner can participate in BOTH; as its business (C-Corp, LLC, LLP, etc) AND as an individual through an SPE.

•The individual does NOT need to reside, NOR does the business need to be incorporated in Pennsylvania, but Pennsylvania taxes must be paid in each case.

How do students qualify to receive these scholarships?

Can I designate my contribution for a specific student?

Students go through the regular scholarship application process at their school.

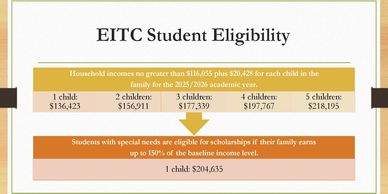

Household incomes can be no greater than $116,055 plus $20,428 for each child in the family for the 2025/2026 academic year.

Can I designate my contribution for a specific student?

Can I designate my contribution for a specific student?

You cannot designate your contribution to a specific student. However, you may designate a specific school or choose to have your contribution undesignated. The schools make their own scholarship funding decisions for qualified students.

How can my business participate?

Businesses should contact PEP at gwen@paeitc.com. to join one of the PEP Special Purpose Entities. PEP accepts both individuals and businesses as members of its entities for EITC participation.

Businesses wishing to apply directly to the Pennsylvania Department of Community and Economic Development for tax credits may do so at Educational Improvement Tax Credit Program (EITC) - PA Dept. of Community & Economic Development. For assistance, businesses may contact the Foundation for Jewish Day School's website for detailed information at www.jewishphilly.org/ways-to-give/eitc/eitc-forms/

Please note the following important deadlines:

- May 15, 2026, as a renewing participant (the 1st year of a new 2-year commitment or the 2nd year of an existing 2-year commitment). EITC participation must be continuous in order to submit your application on May 15th.

- July 1, 2026, as a new participant or if your business is returning to the program after a break of a year or more. If you submit after July 1, you may not be approved as funds are usually fully distributed to July 1 applicants.

- Do not apply earlier than the relevant date above so your application will be considered for the appropriate year.

EITC

The application is available from Pennsylvania's Department of Community and Economic Development (DCED) by clicking here (EITC Business Guidelines).

OSTC

Pennsylvania businesses use the DCED’s electronic single application system, found here. The business application guide provides detailed information. Please note the important dates above as applications are processed on a first-come, first-served basis by day submitted.